- Sales of WFE, NAND and DRAM have increased more than expected this year

- China, Taiwan and Korea remain the epicenters of chip production

- The semiconductor market generated quarterly revenues of more than $200 billion

Global semiconductor product manufacturing equipment sales are expected to reach $133 billion by 2025, up 13.7% year-over-year. These numbers are expected to rise to $145 billion in 2026 and $156 billion in 2027.

The data comes from a new SEMI relationshipwarning that semiconductor manufacturing tools could enter a period of rapid cost inflation, driven by artificial intelligence and cloud computing workloads.

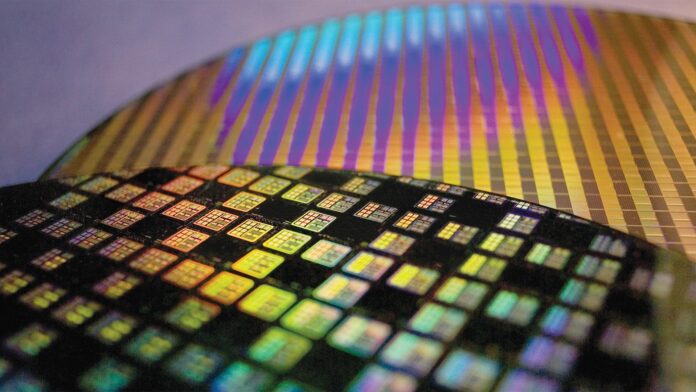

According to the data, wafer fabrication equipment (WFE) costs are rising “as the industry moves towards 2nm gate full node (GAA) mass production.”

High-performance computers are becoming increasingly expensive

After WFE’s revenue rose 9.8% this year, SEMI expects two consecutive years of growth of 5.5% and 6.6%, respectively, as chip makers increase their capabilities in artificial intelligence accelerators, high-performance computing and advanced mobile processors.

Demand for high-bandwidth memory is also driving higher memory-related investments, with the NAND market alone expected to grow by around 45.4% this year. Sales of DRAM devices are also expected to increase by 15.4% this year.

“Investments to support AI demand have been higher than expected compared to our half-year guidance, helping us improve the outlook for all segments,” said Ajit Manocha, CEO of SEMI.

Most investment is expected to be concentrated in China, Taiwan and Korea for the foreseeable future, but all affected regions are expected to see growth over the two-year period for which SEMI has released its forecast.

Individual, My God announced a 14.5% quarter-over-quarter sales increase in the semiconductor market, surpassing $200 billion for the first time (to $216.3 billion).

“Conventional DRAM demand is growing alongside HBM as AI inference workloads increase, leading to exceptional near-term price growth,” said Lino Jeng, senior principal analyst.