Saber Interactive terminated its connection with Embracer Group, buying back the rights to its work as well as a significant portion of its network of studios and contractors.

Recently, Saber co-founder Matthew Karch established Beacon Interactive, a holding company backed by private investors that has acquired Saber, along with many of its subsidiaries, for $247 million (via VGC). The acquired companies comprise over 3,000 developers, including Mad Head, DIGIC, Nimble Giant, Fractured Byte, Slipgate, 3D Realms, New World Interactive, SPL, Stuntworks, Bytex, 4A Games, and Zen Studios. However, there’s an option to purchase Zen and 4A within a specific timeframe, which would raise the purchase price to approximately $500 million, factoring in the value of shares and liabilities being exchanged.

In a letter obtained by Bloomberg News and shared on X (formerly Twitter) by journalist Jason Schreier, Karch articulated his perspective on the transition.

Embracer’s official announcement of the deal is a little misleading. Saber is actually bringing along 4A Games (Metro) and Zen Studios (Pinball) through options, which (combined with liabilities) amounts to a purchase price of around $500 million as Bloomberg reported last month https://t.co/3Pj0TQ5FSt

— Jason Schreier (@jasonschreier) March 14, 2024

“We’ve specifically chosen these studios for acquisition because we believe they epitomize the essence of Saber’s potential. This collective encompasses some of the most skilled and innovative developers globally. Our track record, and more significantly, the projects we’re currently developing, attest to our capabilities. I genuinely believe that we now possess the finest assembly of game developers in the industry, thanks to all of you.”

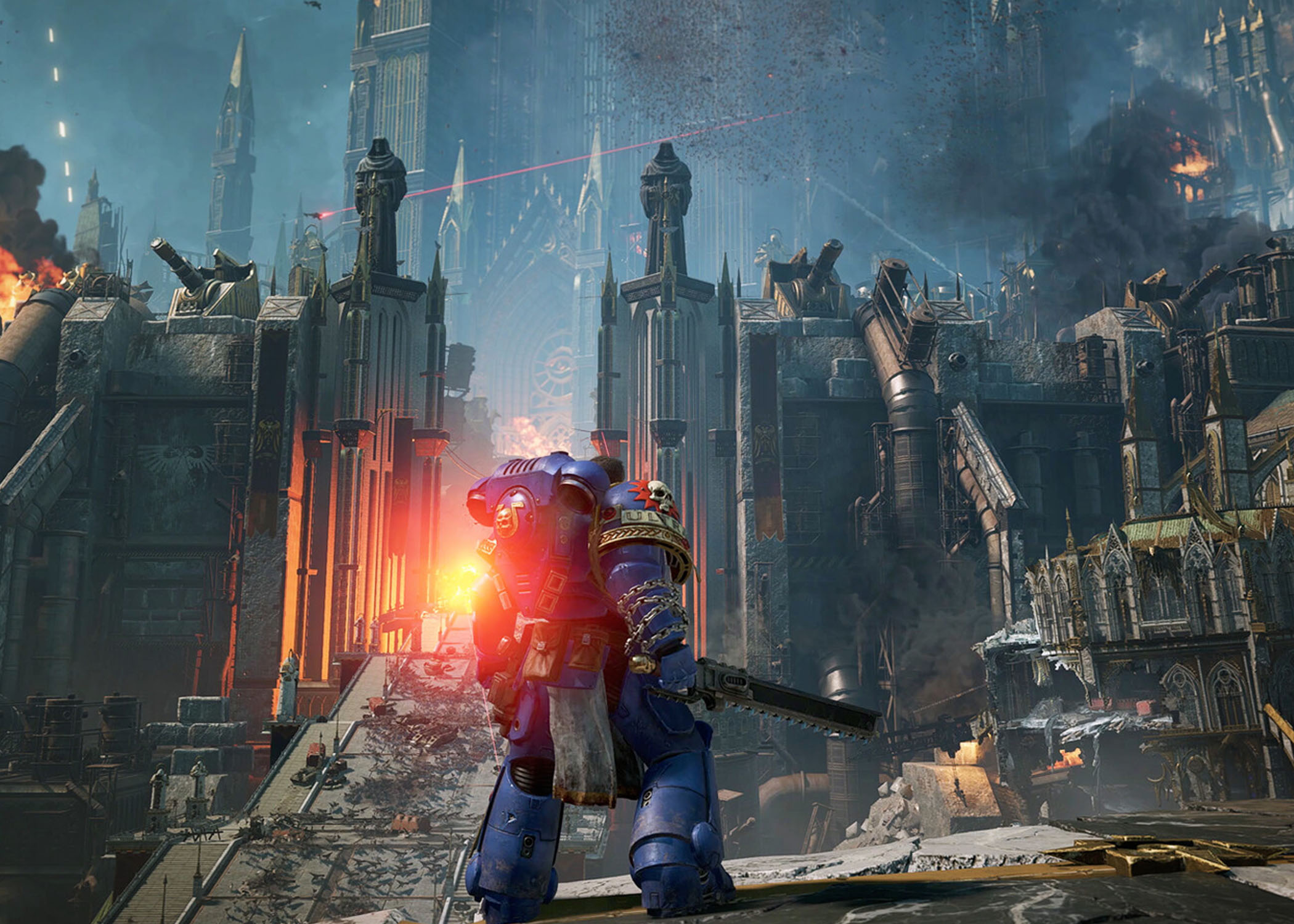

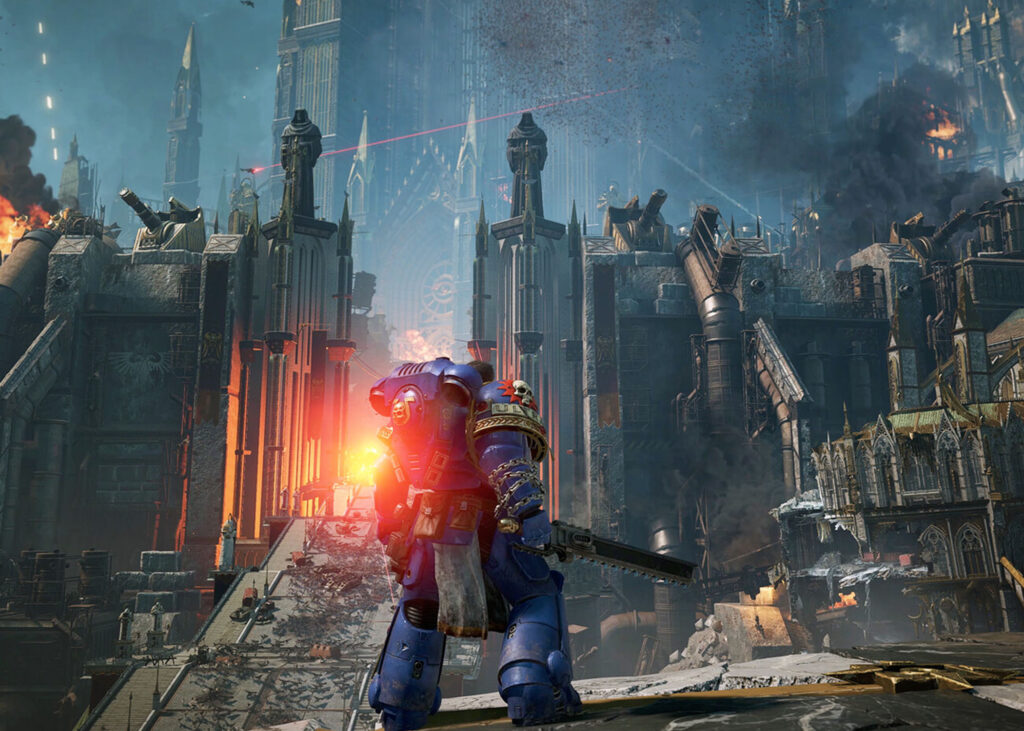

For those unfamiliar, Saber Interactive is currently overseeing more than 38 projects, including Warhammer 40,000 Space Marine 2 and a remake of the classic sci-fi RPG Knights of the Old Republic.

This deal also signifies the conclusion of Embracer’s operations in Russia.

Embracer CEO Lars Wingefors described the move as a “mutually beneficial solution for Embracer and the segments of Saber now departing from us. This transaction positions both companies better for future success […] Immediate improvement in cash flow is evident, and we remain dedicated to reducing net debt. The deal provides additional flexibility to manage debt per existing bank agreements and enhances financial maneuverability.”

Embracer’s ‘restructuring’ in the past six months has led to significant job losses, affecting over 900 employees between September and November alone.

Hopefully, this transaction signals a shift by Embracer towards more sustainable business practices.