Following the latest Xbox Podcast, which unveiled plans to bring four classic titles to non-Xbox platforms, a question arose: Why does Microsoft, primarily a software and services company, maintain a console division?

This inquiry, echoing sentiments from the launch of the original Xbox in 2001, warrants revisiting given the significant shifts in the gaming landscape over the past 23 years. Despite initial struggles, Microsoft solidified its position in the industry with the Xbox 360, though it now finds itself in a distant third place with the Xbox Series consoles.

Amidst these changes, Microsoft has undergone a remarkable transformation, evolving into a major game publisher boasting over 30 in-house studios, many with a rich history of multi-platform development. Additionally, the company operates Game Pass, one of the largest game subscription services globally. Microsoft’s strategy is evident: Drive console sales and promote subscription services featuring games developed at cost by its studios.

However, a critical challenge persists: capturing the necessary audience.

During the pandemic years, Game Pass experienced rapid expansion, soaring from 10 million subscribers in April 2020 to 25 million by January 2022. Subsequently, it gained only 9 million more subscribers, reaching a current total of 34 million. Notably, Microsoft rebranded its Xbox Live Gold service, previously boasting 11.7 million subscribers in 2022, as Game Pass Core. The inclusion of Core subscribers in the 34 million total suggests stagnant growth in Xbox subscribers since 2022, although the ratio of Ultimate to Core subscribers may be favorable.

Comparisons between Game Pass and Netflix’s growth trajectory have faded, highlighting a crucial disparity: Netflix doesn’t market $400 hardware to access its service.

Microsoft grapples with the intricacies of its gaming strategy: sustaining a subscription service demands continual content updates, while a console necessitates exclusive titles to entice buyers. Despite Game Pass’s allure, it alone cannot drive hardware sales.

Meanwhile, competitors like Nintendo and Sony excel in delivering exclusive gaming experiences, pivotal for console sales. Sony continues to dominate hardware sales, outselling Microsoft 2:1, while the Switch likely surpasses combined Xbox One and Xbox Series console sales. Although Sony acknowledges the PC market’s influence and Nintendo retains successful mobile games, neither company shows signs of altering its console-centric strategy.

Microsoft’s announcement to extend four undisclosed titles to “other consoles” sparks curiosity. While I’m a Game Pass subscriber, I question whether I would have invested $30 in Hi-Fi Rush or $40 in Grounded, regardless of my enjoyment. Phil Spencer, Xbox chief, hinted that these games, along with Pentiment and Sea of Thieves, might be part of this initiative:

“We looked at games that are over a year old … A couple of the games are community-driven games, new games, kind of first iterations of a franchise that have reached their full potential, let’s say, on Xbox and PC … Two of the other games are smaller games that were never really meant to be built as kind of platform exclusives and all the fanfare that goes around that, but games that our teams really wanted to go build that we love supporting creative endeavors across our studios regardless of size.”

While expanding these titles to other platforms may not significantly alter Microsoft’s trajectory, it does raise questions. While I’m glad more players will access Hi-Fi Rush and Pentiment, Microsoft risks diluting the incentives for purchasing an Xbox.

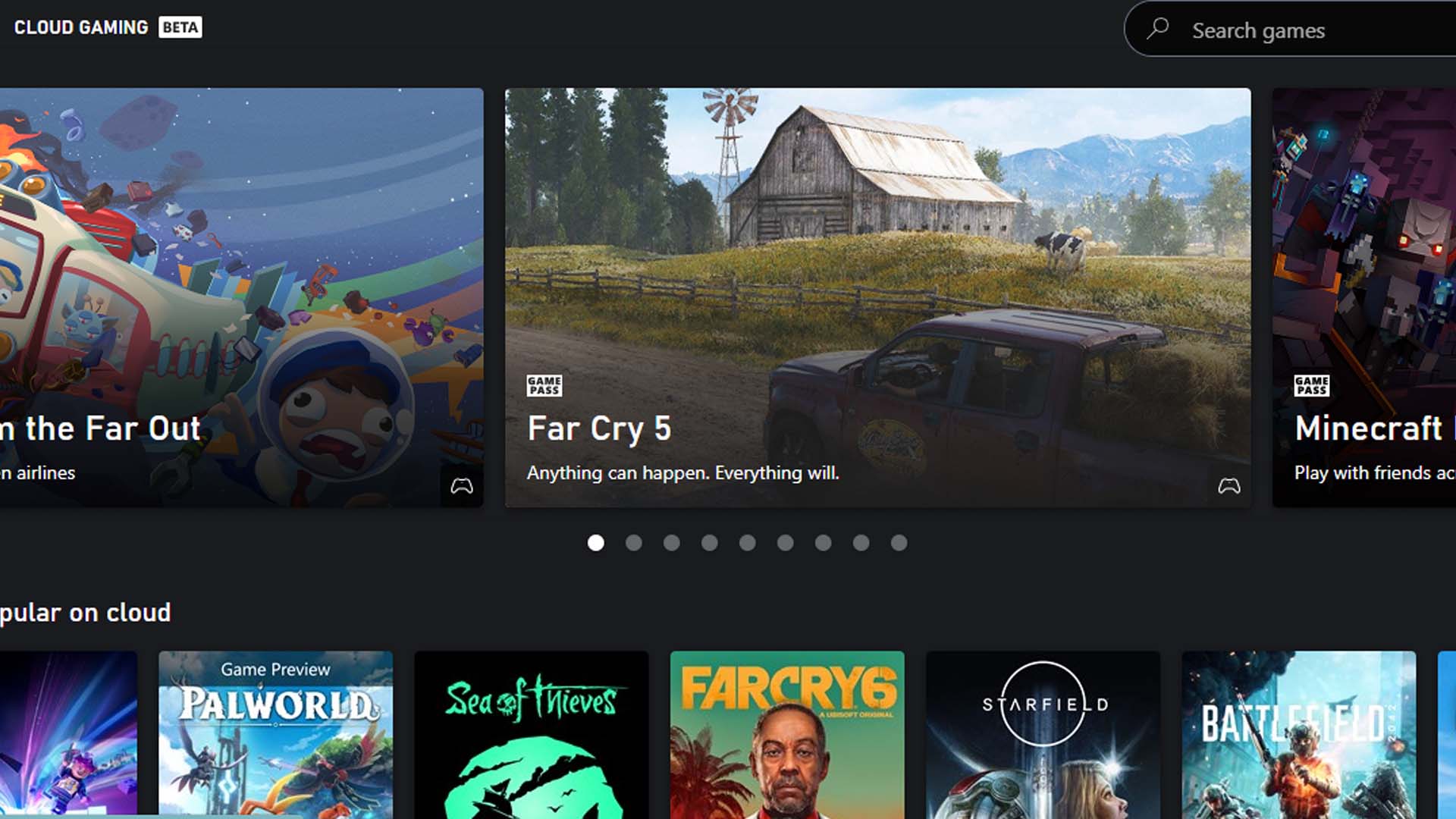

Microsoft’s long-term vision appears centered on cloud streaming, transforming any screen into an Xbox. Although progress has been made in expanding its app to various platforms, support for Microsoft’s Game Pass app for cloud streaming on TVs or streaming boxes remains limited. While options like GeForce Now offer promise, widespread adoption of cloud gaming as a primary platform is still years away.

As the console generation approaches its midpoint, Microsoft faces challenges with its relatively small audience. Game Pass subscriptions plateau, and non-PC PlayStation or Switch users lack access to Xbox games. Despite owning additional game studios worth approximately $76 billion, Microsoft’s position resembles the Xbox One era.

Rumors circulate about premier Xbox games launching on other consoles post-exclusivity periods, highlighting the difficulties of producing major titles for limited audiences. While anticipated first-party releases like Hellblade II and Indiana Jones may boost Microsoft’s prospects in 2024, they’re unlikely to drive substantial growth in Xbox sales or Game Pass subscriptions.

As a third-tier player in the console market, Microsoft confronts tough decisions. Releasing AAA titles on PlayStation could spike game sales but diminish Xbox’s appeal. While Microsoft could afford multiplatform releases while maintaining its console business, agreements like the non-exclusive deal for Call of Duty until 2034 limit its leverage.

Considering a future in cloud gaming, Microsoft’s commitment to new hardware raises questions. Exiting the console market gracefully and focusing on game development for rival platforms could position Xbox favorably in a post-console era. Collaboration with PlayStation, Switch, and PC could broaden Microsoft’s reach, akin to strategies employed by publishers like Ubisoft and EA.

While awaiting the maturation of cloud gaming, Microsoft’s games, and Game Pass, might find optimal placement on PlayStation, Switch, and PC.