- Cambricon plans to produce 500,000 AI accelerator chips next year

- The Siyuan 590 and 690 models represent 300,000 units

- Current yield is still extremely low, only 20%.

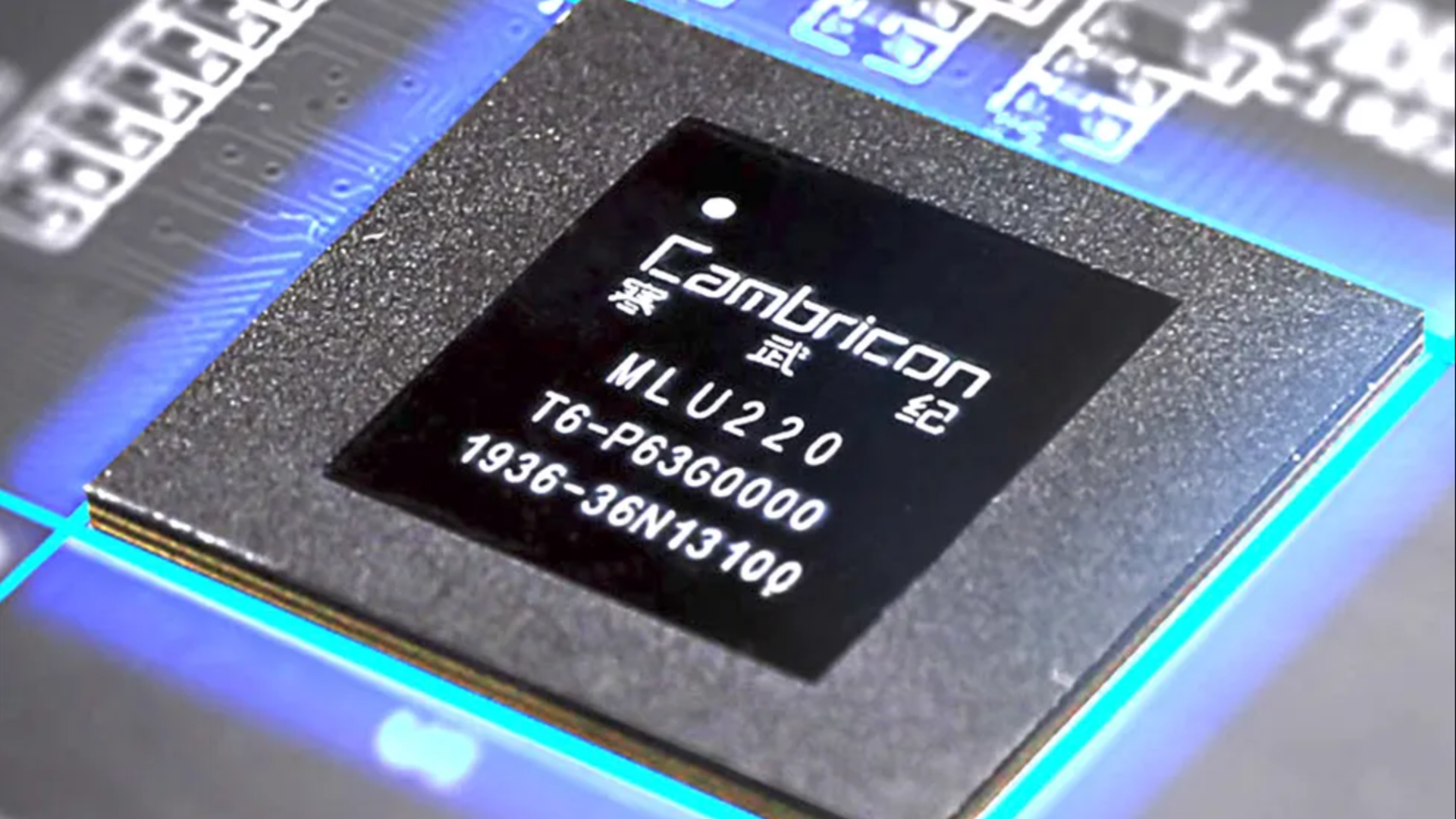

Chinese chipmaker Cambricon Technologies aims to triple its AI chip output by 2026, filling the void left by Nvidia’s withdrawal from the Chinese market.

Bloomberg Information The company plans to produce around 500,000 AI accelerator chips next year, of which 300,000 units will consist of the flagship Siyuan 590 and 690 models.

This represents a notable increase from the approximately 142,000 units expected in 2025, but Cambricon still faces significant production challenges.

Manufacturing challenges and performance limitations

The stated performance of the 590 and 690 chips is only 20%, meaning that only one in five chips produced is usable.

Even if Semiconductor Manufacturing International’s capacity were available, actual production may be much lower than expected.

By comparison, TSMC’s 2nm technology, which is seven generations ahead of SMIC’s capabilities, reaches 60% efficiency, highlighting the efficiency gap.

Memory shortages, including HBM and LPDDR components, threaten the ability to meet production targets and potentially slow delivery to data center customers.

Cambricon’s move comes as Chinese companies such as Alibaba and ByteDance increasingly prefer local suppliers.

They are supported by Chinese government incentives aimed at strengthening China’s independence in the semiconductor industry.

Cambricon’s reported sales increased fourteen-fold in the most recent quarter, driven by strong domestic demand and investor confidence.

However, this project will put Cambricon in direct competition with tech giant Huawei, which wants to double its chip production, increasing the pressure on Cambricon.

The two companies compete for similar wafers and production resources, creating bottlenecks that can limit production speed and scale.

Cambricon’s strategy relies heavily on SMIC’s 7nm “N+2” process node, but it is unclear whether it can support large-scale production.

Trade restrictions and chip embargoes over the past year have limited access to high-quality AI hardware, making domestic options critical to national AI ambitions.

The gap between current Chinese semiconductor technology and its Western competitors such as Nvidia, AMD and Intel remains wide.

Cambricon GPU chips are still far behind the world’s leading products in terms of performance and efficiency.

CPU workloads in Chinese data centers may remain dependent on existing infrastructure as AI accelerators are developed.

The integration of these new chips into workstations will likely be tested as companies adapt to the limitations of local hardware.

From a neutral perspective, Cambricon’s expansion demonstrates the growing strategic importance of domestic AI chip manufacturing.

Strong government support and growing domestic demand bolster its momentum, but inefficiencies and competition for resources may limit its full potential.